extended child tax credit portal

The Child Tax Credit provides money to support American families. 300 is given for each eligible child aged 6 and under and 250 is given for children 6-17 years of age.

Gst Registration Goods And Services Goods And Service Tax Error

350 per month 4200 per year for children ages 0-5.

. For 2022 that amount reverted to 2000 per child dependent 16 and younger. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. Parents have until July 31 to claim the child tax rebate from the Connecticut Department of Revenue Services with payments slated to go out by late August.

In the meantime the expanded child tax credit and advance monthly payments system have expired. Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6. Prior to this years expansion families received a credit of up to 2000 per child under age 17.

Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. 2021 Child Tax Credit and Advance Payments 2021 Tax Filing Information. IRS Child Tax Credit Portal and Non-filers.

The credit will be. The Child Tax Credit provided a credit worth up to 1000 per child. Heres everything that changes.

The application and pointers are online at portalctgovdrs with phone assistance available through a DRS hotline at 860-297-5999 or the United Ways 2-1-1 assistance line. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children. How To Change Your Direct Deposit Information on the Child Tax Credit Update Portal Checks in the amount of either 300 or 250 will be deposited for the majority of the millions of recipients who are scheduled to receive them.

See below for more information. The credit amount was increased for 2021. The extended child tax credit faces a tough road to renewal in the Senate.

Thats why we are calling upon Congress and the Administration to unite behind Utah Senator Mitt Romneys Family Security Act a proposal to replace the Child Tax Credit with a flat child allowance equal to. The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17. 2022 Child Tax Rebate.

But others are still pushing for. Specifically the Child Tax Credit was revised in the following ways for 2021. The credit was made fully refundable.

The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17. Previously the credit was 2000 per child under 17 and will revert back to that. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

Last year the tax credit was also fully refundable meaning that if the credit amount a taxpayer qualified for exceeded. It also made the. Sign up for our newsletter to receive our top stories based on.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. Tax season brings its fair share of uncertainty for us non-CPAs and thats even more true this year. No portion of the credit was refundable so if it reduced your tax liability to zero the excess credit had no effect on your refund.

For individuals who did not file a return but were not eligible for automatic payment of EIPs the IRS set up a. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. Child Tax Credit.

But others are still pushing for. 250 per month 3000 per year for children ages 6 to 17. It also provided monthly payments from July of 2021 to December of 2021.

The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account. Here is some important information to understand about this years Child Tax Credit. The Additional Child Tax Credit was an entirely separate tax credit but it applied only to families with earned income above 3000.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. The credit will be fully refundable. As part of its COVID-19 relief package Congress has changed the requirements and amounts of certain tax credits hoping to ease the financial burden weighing on many familiesOne of the biggest changes has been the expansion of two tax credits the child tax.

For 2021 only the Rescue Plan raised the maximum Child Tax Credit from 2000 to 3600 for children under 6 and 3000 for children aged 6-17 the first time 17-year-olds were included. Congress fails to renew the advance Child Tax Credit. The expansion imposed as part of the.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. The advance Child Tax Credit or CTC payments began in July 2021 and end by 2022.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. For children under 6 the amount jumped to 3600. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

The credit amount was increased for 2021. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through as long as 2025 as part of the American Families Plan.

Gstr 9 Due Date Annual Return For Fy 2020 21 Tax Consulting Due Date Annual

Infographic Cool Facts About How Solar Energy Works Sunpower Solar Blog How Solar Energy Works Solar Energy Solar

Gst Cbic Extends Gstr 9 And Gstr 9c Filing Dates In A Staggered Manner Retail News Goods And Service Tax The Borrowers

Infographic Cool Facts About How Solar Energy Works Sunpower Solar Blog How Solar Energy Works Solar Energy Solar Energy Diy

Gstr 1 Gstr 2 And Gstr 3 Due Dates Extended Dating Due Date Extended

Goods And Services Tax Gst Goods And Service Tax Financial Advisory Goods And Services

If You Are Still Struggling With Gst Return Mismatches Then Hostbooks Gst Is Right Here To Help You Out We Billing Software Accounting Software Payroll Taxes

Gstr 9 Due Date Annual Return For Fy 2020 21 Tax Consulting Due Date Annual

Super Cool Taxtips To Help You Win Taxes Visit Https Tax2win In File Your Return For Free Itr1 Itr Taxtips Tax2win Hap Tax Credits Tax 2 More Days

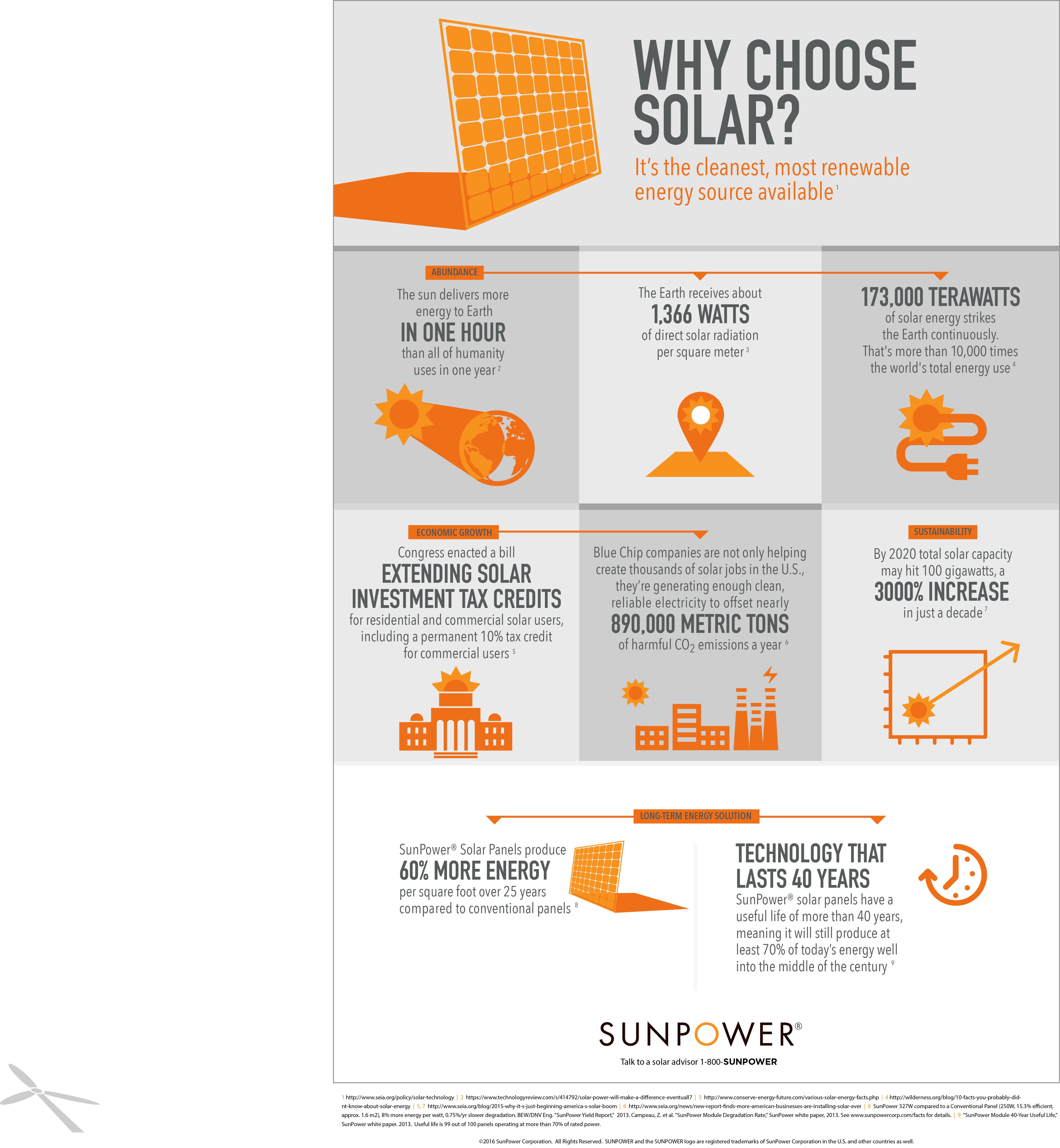

Why Choose Solar Solar Energy Design Solar Energy Renewable Energy Technology

Why Choose Solar Solar Energy Design Solar Energy Renewable Energy Technology

Govt Clarify Last Date To Avail Gst Input Tax Credit For Fy 2017 18 Gs Tax Credits Last Date Tax

Toyota Prius Plug In Hybrid Ultimate Guide What You Need To Know Toyota Prius Prius Hybrid Car

Gst Returns Due Dates Accounting Taxation Due Date Dating Goods And Service Tax

Support Tickets System For Mailwizz Ema Priority Management System Supportive

Pin By Tax4 Wealth On Gst Announcement Financial Management Social Media

A Complete Guide On Income Tax Refund Status Income Tax Income Tax Return Income